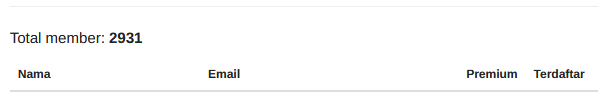

asdar.id menyediakan Member Premium Download untuk download file tanpa embel-embel iklan dan halaman, apa lagi harus menunggu timer yang begitu lama. Dengan berlangganan Member Premium Download, semua file dapat didownload dengan singkat langsung menuju ke sumbernya!, klik DISINI untuk DAFTAR atau DISINI untuk LOGIN :-) Jika ada pertanyaan silahkan hubungi Admin DISINI. Untuk cara download file Member Free Download, bisa membaca Tutorial Download yang ada dibawah Timer (halaman Safelink) saat menekan tombol download.

asdar.id menyediakan Member Premium Download untuk download file tanpa embel-embel iklan dan halaman, apa lagi harus menunggu timer yang begitu lama. Dengan berlangganan Member Premium Download, semua file dapat didownload dengan singkat langsung menuju ke sumbernya!, klik DISINI untuk DAFTAR atau DISINI untuk LOGIN :-) Jika ada pertanyaan silahkan hubungi Admin DISINI. Untuk cara download file Member Free Download, bisa membaca Tutorial Download yang ada dibawah Timer (halaman Safelink) saat menekan tombol download.This afternoon time to post article about 5 Steps To Take Together With Your Student Education Loans When You Graduate. When you initially graduate from university, you might be more centered on finding employment and setting so you usually do not pay much focus on your student education loans.

The education loan counseling necessary for graduation may briefly clarify your responsibilities, nonetheless it is essential that you consider action together with your student education loans now, despite the fact that they is going on automatic deferment for the first half a year after your graduation.

1. Upgrade Your Contact Information

It is necessary to upgrade your contact info for your student education loans when you initially graduate and each and every time you move. You it’s still in charge of making obligations after half a year set up statements make it for you. Updating your details and utilizing a long term address (such as for example your parents’ address) as a back-up will assist you to have the information regularly and determine the easiest method to manage your student education loans.

2. Verify Your Deferment

Although your student education loans are likely to automatically continue deferment when you graduate, sometimes there exists a mistake and the student education loans do not. You may end up getting late costs and interest obligations if you don’t verify that the student education loans are on deferment. A straightforward telephone call to your lender will help you to verify this and save the trouble of straightening out chaos after it occurs.

3. Consolidating Loans

You might have the choice to consolidate your subsidized and unsubsidized loans into one payment once you graduate. It is easier to create one education loan payment than it really is to be concerned about making many. However, you must never consolidate federal student education loans in together with your personal student loans.

This may cause you to reduce the benefits that include student loans just like the Income Based Payment option or a hardship deferment in the event that you lose your task. Private student education loans do not really provide same payment conditions.

You might want to consolidate any private student education loans you have and make an effort to refinance to a lesser interest price that you could lock in It might be difficult to get this done until you have your first job, nonetheless it is certainly something you should think about. Private student education loans possess a higher interest than Federal Direct Loans, in fact it is often variable. Based on the kind of private education loan, you might not have the ability to claim the curiosity as a taxes deduction. Private student education loans must have the same priorities as bank cards with regards to paying down your debt.

4. Find Out In The Event That You Be Eligible for Payment Help or Forgiveness Programs

It really is worth seeking at the various payment options that are offered predicated on income and work choice. The Income Centered Payment choice will foundation your payment on your own income. You will have to submit your earnings each year, and since it goes up therefore will your payment. In case you have not really paid your student education loans after 30 years upon this plan the rest of the balance will become forgiven.

You may also temporarily stop making obligations for a hardship deferral in the event that you lose your task or face another financial meltdown. This is decided on a case by case basis and you need to contact your education loan organization before you end making payments to be able to qualify.

Another choice is to consider education loan forgiveness choices. In the event that you function for the federal government or a non-profit for 10-12 months and you possess Federal Immediate Loan, you could have the remaining stability of your mortgage forgiven in case you have paid promptly during those a decade. Teachers be eligible for an identical program, however the term is normally five years. Some says may present different mortgage forgiveness options, and some careers may give incentives and cash to place toward your education loan as a signing reward or once you have worked well there for an arranged period.

Making the effort to consider these options could help you save cash and determine the simplest way to cope with your student education loans right now and in the foreseeable future.

5. Make an idea to Pay out Them Off

Education loan debt could be crippling, particularly when you are struggling to create ends talk with your 1st work. It is necessary to create a strategy that will enable you to pay back your student education loans as fast as possible. One component of the is establishing a spending budget that leaves space for extra obligations on your personal debt. You should focus on your personal student education loans and any customer or personal credit card debt you have from college, and move to your federal student education loans. It is because the interest is leaner, and because you can state some of the curiosity on your own taxes. You may want to be creative to find extra cash to pay out on your student education loans like dealing with a second work or freelancing to generate the excess money.

So many posts this time about 5 Steps To Take Together With Your Student Education Loans When You Graduate, hopefully useful for you. Do not forget to always share one kindness by sharing or sharing this article to friends in social media, thanks!

![√[PLUS GAMBAR]Download RAB Aparatur Gampong Format Excel gambar dan rab aparatur gampong](https://www.asdar.id/wp-content/uploads/2025/03/gambar-dan-rab-aparatur-gampong-180x135.jpg)